Welcome to MedNet

Updates and resources for faculty and staff at UBC’s Faculty of Medicine

WHAT’S NEW

-

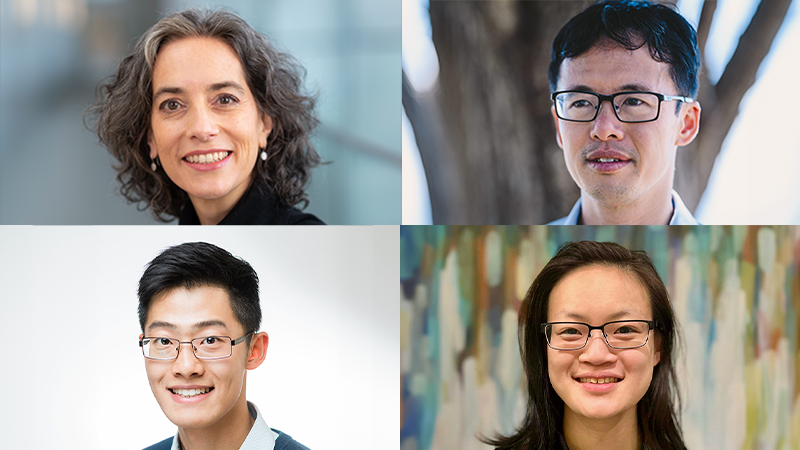

Faculty & learners recognized by Medical Alumni Association

Award recipients helped build a more dynamic & robust medicine community through their service and actions.

FEATURED RESOURCE

The Hybrid Work & Communication Toolkit: Establish shared norms and understanding about how to communicate and collaborate with your team in a hybrid workplace.

EVENTS

View the calendar to find events happening across the Faculty of Medicine.

Reinventing Cardiac Care: A New AI-Empowered Paradigm

April 25, 5:30–8:30 pm

UBC Medical Alumni Celebration & Awards

May 2, 6–8 pm

FACULTY & STAFF SPOTLIGHT

Meet faculty and staff members from across the Faculty of Medicine.

-

Dr. Hanh Huynh

Meet Dr. Hanh Huynh, Associate Professor of Teaching in the Department of Pathology & Laboratory Medicine.

-

-

Mona Shum

Congratulations to Mona Shum, who was recently honoured with an Alumni Builder Award by alumni UBC.

Transformation of culture

Learn more about the Faculty’s commitment and actions toward creating respectful and inclusive learning and work environments

Strategic Plan

Learn about the UBC Faculty of Medicine 2021-2026 Strategic Plan: Building the Future

NEWS & HONOURS

Read the latest news and stories from across the Faculty.

Fueling a B.C. biotech boom

Explore how UBC Medicine researchers, learners and spin-off companies are propelling the growth of British Columbia’s life sciences sector.

PATHWAYS

Read our current issue: